The British consumer continues to lead the way in adoption of mobile technology, however bricks and mortar still play a role in shopping according to the Google Consumer Barometer. Based on the survey, almost three-quarters […]

The British consumer continues to lead the way in adoption of mobile technology, however bricks and mortar still play a role in shopping according to the Google Consumer Barometer.

Based on the survey, almost three-quarters (71%) of Brits have a smartphone compared to 61% in Europe as an average.

Peter Cory, agency sales director at Google, commented: “Consumer habits are changing fast, making it challenging for brands to understand and predict how and when it’s best to reach them. In the UK alone, we’ve seen significant increases in the number of devices owned and that’s having a direct effect on the way consumers conduct their day-to-day lives – how they consume media, how they research products and how, when and where they buy."

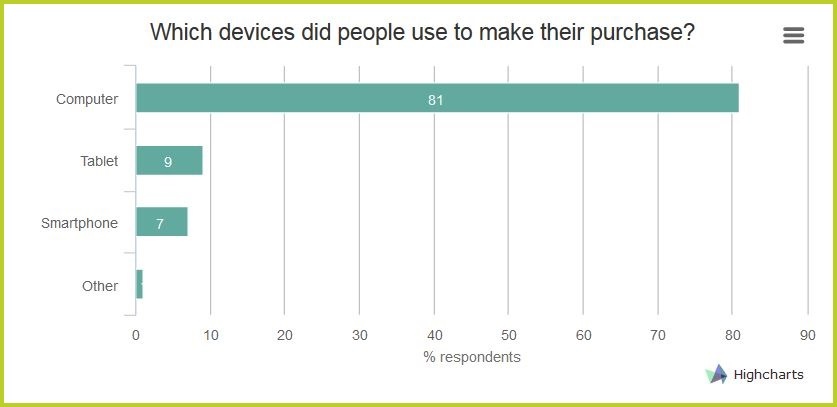

Although we have seen a huge rise in mobile adoption, traditional personal computers still account for 81% of purchases:

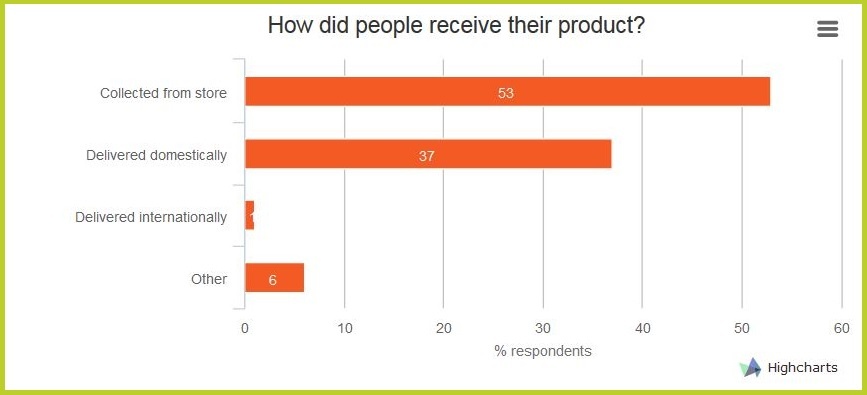

More than half (53%) of surveyed shoppers pick-up goods purchased in-store.

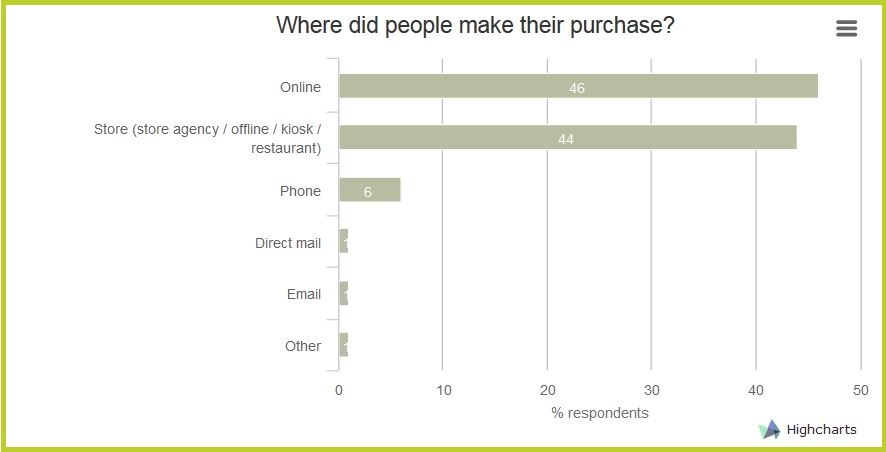

Almost half (46%) of those surveyed completed their transaction online compared to 44% who carried it out in-store.

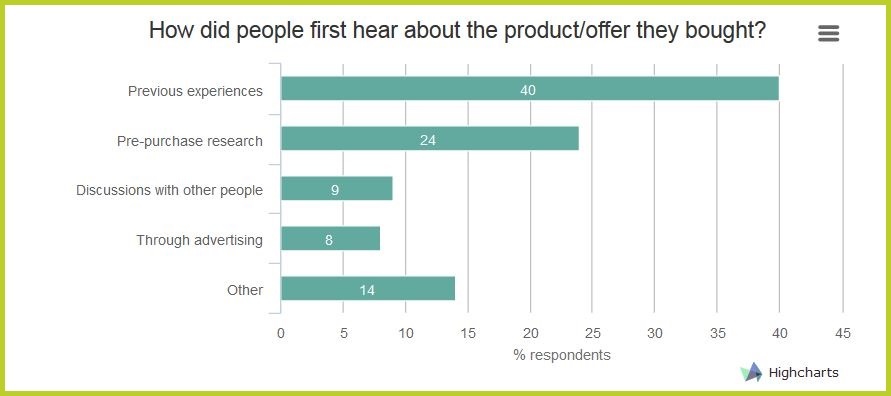

The survey showed clearly that consumers are more likely to purchase based on previous experience, rather than purely based on any pre-purchase research. This clearly demonstrates that the post purchase experience is as if not more important than how products and pricing are made available to consumers. Word of mouth (Discussion with other people) rated 3rd most important in the buying decision.

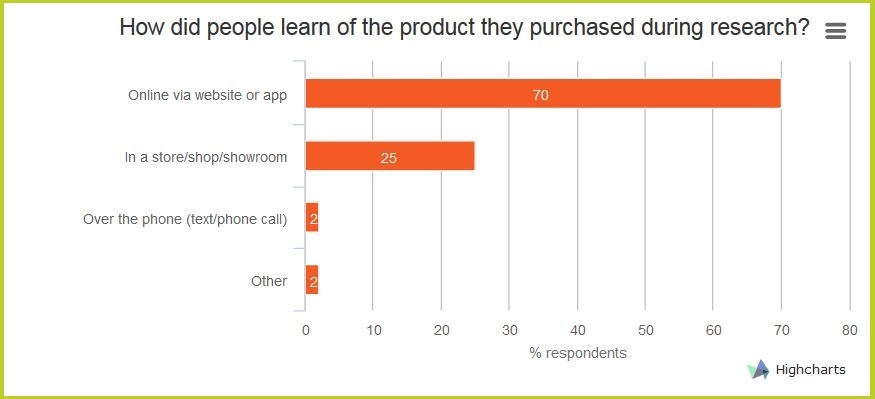

Research prior to purchase was predominantly conducted using online methods, including websites or apps. This goes hand in hand with the growth of mobile while more retailers are embracing the mobile opportunity and ensuring that their products are accessible regardless of device or online channel used.

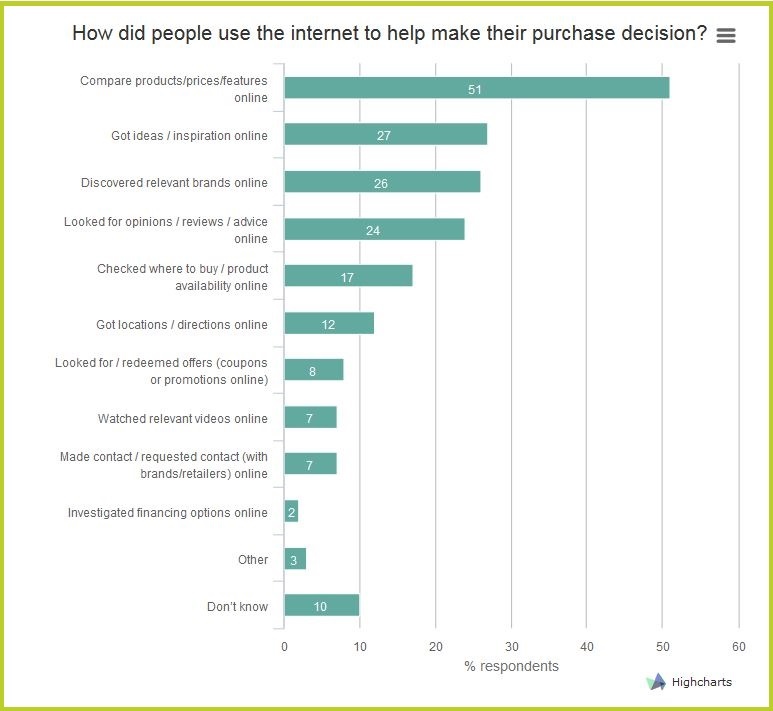

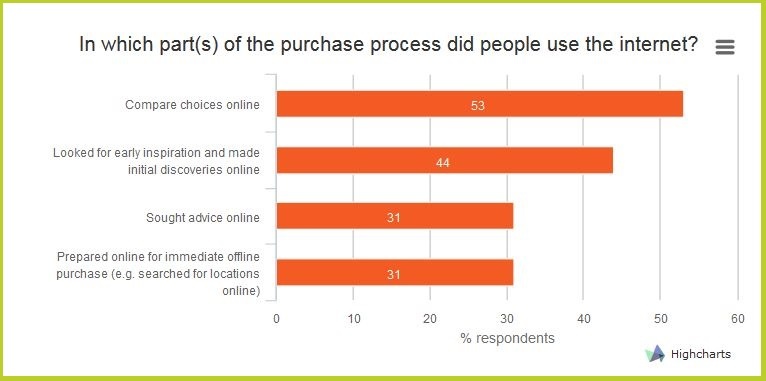

Over half (51%) of those surveyed used the internet to help them compare products, prices and features. As online channels become more accessible for consumers, it has never been so important for retailers to embrace the many online channels available to them. Not just being everywhere but ensuring that their products are represented in the best possible way. This can only be achieved by having good quality product data feeds while running efficient, product level advertising campaigns.

The overlying majority (53%) of those surveyed used the internet to compare prices. The information listed in retailers product feeds should maximise the pricing opportunity, not just listing the "current retail price" but taking advantage of other pricing attributes such as "sale price", "discount value" and "promotional messages" such as special discounts etc may also be available.

For more information on how to increase the quality of your product data or how to maximise the opportunities that online channels may hold for your products, both at home and abroad, contact us today for a no obligation chat and to arrange a platform demo.

Methodology: Respondents were asked how they bought one recently purchased product within categories including clothing, footwear, groceries, cosmetics and entertainment.

For more information on the data, visit The Consumer Barometer Survey 2014/2015 Note: Answers may not sum to 100% due to rounding, no answers, don't knows.

River Island

River Island