We've analysed the performance of the impact of Covid19 on e-commerce, one year after lockdown, and how the U.K. retail industry adapted.

A year ago the UK went into its first lockdown. COVID-19 forced the closure of offices, shops, restaurants and other sectors, marking a watershed for many UK businesses. Being deep in unfamiliar waters, some companies didn’t survive, whilst some depended on government support to keep their heads above water and others thrived.

We've analysed the performance of the retail industry and how the ecosystem adapted to the ever-changing demands and consumption habits of consumers across the nation.

CHANGE OF CONSUMER BEHAVIOUR

We've seen a substantial change of consumer behaviour.

A BIG JUMP IN DIGITAL ADOPTION

The pandemic ripped through the globe, forcing people to stay at home and bricks & mortar stores to shut their doors. Unsurprisingly, this stimulated a change in consumer behaviour to further favour the rise of e-commerce.

According to Adobe research on digital trends, while digital sales have had a continuous upward trend in the last 10 years, the pandemic has strongly accelerated consumer adoption at a rate that amounted to a jump of five to ten years. Not only were new buyers come into play here but buyers who have shopped digitally before, were buying more, and more frequently.

In EMEA, 55% of consumers now shop online more frequently than they did during the first lockdown – and for frequent online shoppers, this figure rises to 65%. At the same time, 60% have seen an increase in their online spending since the COVID-19 outbreak began, increasing to 71% for frequent users.

There’s two things to consider. From one side, this can be explained by the fact that people have been forced to be at home, but still need to purchase both essential and not essential goods, which they would normally buy offline.

On the other hand, it’s about the friction that buyers face when they shop online versus offline. Google analysed that the pain points shoppers have when shopping in-store increased in 2020, with nearly half (48%) of U.K. consumers facing an issue, compared to 42% in 2019. In contrast, 33% of shoppers faced an issue shopping online, compared to 41% in 2019, demonstrating the progress that retailers have quickly made to address any customer experience obstacles.

While in-store pain points are mostly related to COVID 19 (queues, social distancing etc), online pain points are mostly related to the purchasing journey e.g.

- the focus on the need to signing up before buying

- customer reviews being hard to find

- a slow customer service

THE PURCHASE JOURNEY HAS CHANGED

Now more than ever, online retailers and brands need to prioritise building a frictionless purchase experience both offsite and onsite. As an example, Adobe estimated that accurate product descriptions are in the top 3 things consumers look for in a retailer’s website content.

But accurate product descriptions are just a small piece of a much bigger jigsaw of today's consumer behaviour. Speed plays a crucial role too.

According to further research by Adobe on shopping behaviour during COVID-19, over half of U.K consumers (54%) say the pandemic has changed their expectations of online shopping. Of this, 70% are more likely to shop elsewhere if they can’t find products quickly. Remember, buyers attention is hard to get and easy to lose.

And they’ve got plenty of channels to buy from.

The shopping experience over the years has become increasingly multi-touch, and the attitude towards channels has changed drastically within the pandemic, as buyers become more “channel-agnostic”.

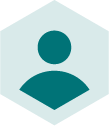

The following image shows how buyers are relying on a variety of channels, especially in the Fashion vertical, which saw a 20% increase in channel-agnostic buyers.

With customers less likely to be loyal to a channel and constantly navigating through their options, their ability to gather, analyse and take action based on data is of paramount importance.

It’s time for businesses to put data agility and digital maturity into their executive conversations. Being able to slice and dice data to connect the dots of customer acquisition, and to act on valuable insights can determine the victory of a business.

Google identified six enablers of digital maturity:

- Connecting first-party customer data across multiple touchpoints

- Linking marketing objectives for unified brand goals

- Automating tasks and tailoring messages for maximum impact

- Establishing strategic partnerships with shared marketing objectives

- Training and hiring for advanced data science and analytical skills

- Having agile multifunctional teams with an established test-and-learn culture

BRAND LOYALTY VS AVAILABILITY & CONVENIENCE

It’s a challenging time for the retail industry as brand loyalty is diminishing, according to an Adobe study.

Customers want to compare products, analyse reviews, have delivery & collections options that suit their needs, and that’s just a fraction of it.

Consumers who bought from new brands or tried new retailers in 2020, were not overly concerned about quality or recommendations from other shoppers.

In the U.K., buyers mentioned availability (44%), price (43%), convenience (36%), and speed (33%) as crucial elements to make their purchase decisions.

In addition, “near me” queries have increased, as shoppers were looking to fulfil their needs locally. Leveraging these queries properly, giving correct information about opening times, stock availability and collection options, fulfils a buyer’s needs to build a better purchase experience.

Brands and retailers must understand their customers, uncover what they’re searching for and adapt to their needs.

Luckly, it’s not all doom and gloom. Although customers seem to be less loyal to a brand, the shift to digital has made businesses more able to know their audience and take more informed decisions.

SHOPPERS ADAPT TO THEIR NEW NORMAL

During pandemic, we saw a change in what products buyers have been purchasing.

With the UK pubs closed, it’s clear that the sales on beer and spirits online would increase.

Grocery and home and garden has also performed very well, along with beauty products as the hair salons and nail bars had to close.

Fashion was initially hit fairly hard, but retailers have quickly adapted.

Looking at our own data analysis, we’ve seen a shift in categories - with some such as formalwear evaporating and, others like casualwear and comfort wear emerging with a steep increase.

COVID-19 saw many companies thinking creatively about how to adapt to the new normal of work-from-home , developing new products and promoting them, with the right creativity, at the right time.

Our client Boohoo revolved their communication around comfort wear and launched a dedicated collection with the hashtag #boohoointhehouse.

The lesson here is clear: speed and agility are important. But this is not a lesson that applies only during the pandemic, but should form the foundation of a business moving forwards.

DIGITAL TRANSFORMATION ACCELERATED

Digital transformation has accelerated beyond B-2-C retail businesses. We’ve seen a substantial acceleration in the innovation brought by big tech companies, such as Google or Facebook. While some features have been simmering in the pan for a while, they have been rolled out to strengthen e-commerce operations, support global and local businesses and give purchasing options to the consumers.

GOOGLE’S FREE PRODUCT LISTINGS

In April 2020, Google introduced its free product listings. Until this point, merchants would list their products on the merchant center to promote them via paid shopping ads. Now it’s “free” to sell on Google. Initially rolled out in the US, free product listings are now available in the U.K. (and Europe, Australasia, and Africa).

With free product listings, merchants can now show their products across Google surfaces, like the Shopping tab, Google Search, Google Images, Google Maps and Google Lens, enhancing the chances of their products being found.

Needless to say, product data plays a crucial role in listing products seamlessly. A minimum number of product data attributes are required in a feed: [id], [title], [link], [image_link], [price]. On top of that, Google requires 15 extra mandatory attributes to show products in content-rich format, on Google Shopping tabs. Here are the complete Google Guidelines.

For brands and retailers, this change means free exposure to millions of shoppers. For advertisers and digital marketers, it means extra support for paid campaigns.

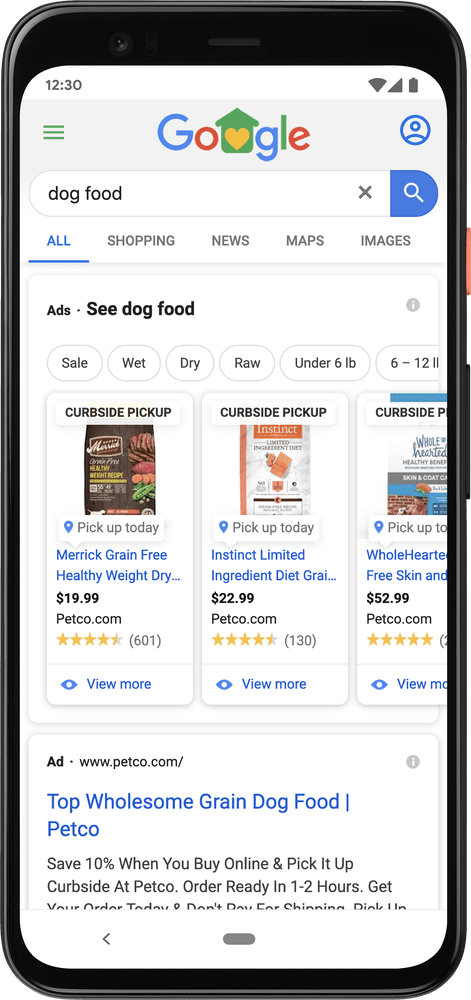

CURBSIDE PICK UP

Curbside pickup is a click & collect option for stores. Shoppers can buy their products online and collect them outside the store while remaining in their cars.

While this feature has been live for a while now it saw a massive adoption from merchants & consumers during the pandemic. Only 27% of EMEA shoppers were attracted by traditional click and collect in 2020 according to Adobe research, amid worries that in-store click & collect is not providing the safe experience consumers are seeking. As an example, keywords such as "safe shopping" were searched 10 times more over the past few months as mentioned by Swati Trehan, product manager of Google Shopping, in a Google blog post. Curbside Pickup addresses this cautious consumer sentiment, whilst providing fast access to products.

To foster safety and product adoption in May 2020, Google added the Curbside Pick up Badge to Local Inventory Ads.

FACEBOOK SHOP

In May 2020, Facebook introduced Facebook Shops, an online store for merchants to sell their products across Facebook and Instagram.

As Facebook explains “People can find Facebook Shops on a business’ Facebook Page or Instagram profile, or discover them through stories or ads. From there, you can browse the full collection, save products you’re interested in and place an order”.

Shoppers can also ask for information directly via messenger chat, Instagram direct messages, or WhatsApp for business.

Facebook rolled this out conveniently during the pandemic, to support SMBs that have seen a slump in their sales. One big benefit for merchants selling on Facebook, compared to other channels like Amazon, is that social media users are “always on”, and merchants can strategically build awareness and consideration for their products on Facebook and Instagram. This helps the drive towards purchasing within the same platform.

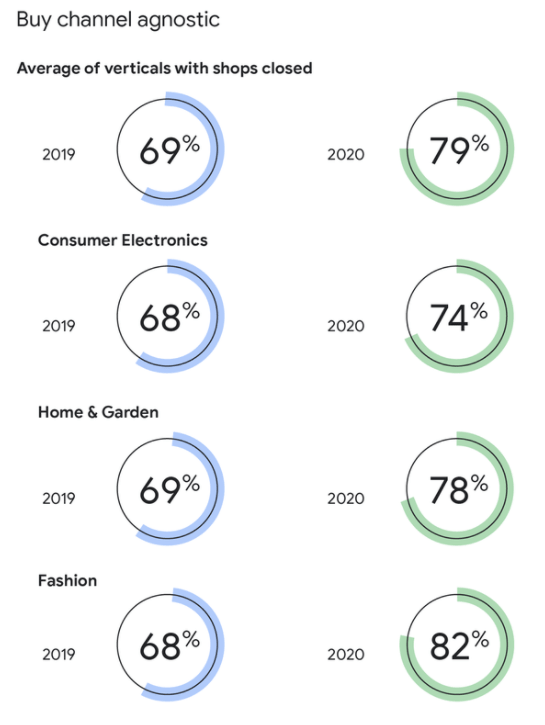

RETAIL INDUSTRY WEATHERS THE STORM AND DIGITAL AD SPEND THRIVES

Have businesses cut their investment on advertising during the pandemic?

Back in May, ad spend was forecasted to plummet across all channels, including digital through to offline advertising.

Fast-forward a few months and the answer is “it depends”.

While businesses have cut investment in traditional forms of advertising, like cinema and outdoors, the latest analysis on the digital spend in the U.K., conducted in Q3 2020 by E-Marketer and Insider Intelligence, estimated a growth of 0.3% of digital advertising. This may not seem meaningful, but closer analysis shows certain industries such as Retail increasing investment dramatically, while others, such as Travel, saw such an impact on their potential business, they cut off their investments across the board.

According to Dentsu Ad Spend’s Report in 2021, the UK ad market is forecasted to grow by 10.4%. This will be largely driven by the forecast growth in digital spend of 10%, which will account for around 70% of overall ad expenditure.

With a bigger investment made on digital ad channels and a rise in competition, it translates into a more challenging form of advertising. With PPC channels such as search, video and display powered by bids, CPC tends to rise and ROAS tends to shrink.

Digital advertisers must get a clear understanding of their data, make informed decisions and run continuous analysis, connecting their first-party data to build an informative, and supportive, “knowledge net”.

GOING FORWARD IN 2021

What are the takeaways from last year?

- Customers are less loyal to products or brands, so businesses must relentlessly work on their customer experience to retain their buyers

- Businesses can transform this digital shift into an opportunity to get to know their customers better and take decisions based on it

- Multi-channel presence is pivotal to attract and retain customers - marketers must be confident in the channels they advertise on and the data they use

- Businesses need to understand and act on data more quickly

- Data Agility and digital maturity must drive discussions and CMOs should take this topic at the executive level of conversation

- Data, Intuition and Creativity, combined with speed, can determine the success or the failure of a business

Win the Product Data Challenges

Explore how the Intelligent Reach platform can help you overcome the e-commerce product data challenges

Book a Free Demo

River Island

River Island